-

ميجا سكان برو: تحليل لظاهرة النمو السكاني الضخمة

ميجا سكان برو: تحليل لظاهرة النمو السكاني الضخمة تعتبر ظاهرة النمو السكاني الضخمة من أهم التحديات التي تواجه العالم في العصر الحديث، حيث تتزايد الضغوط على…

-

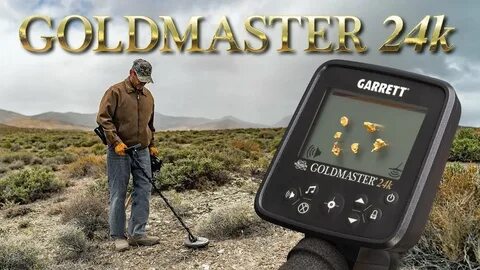

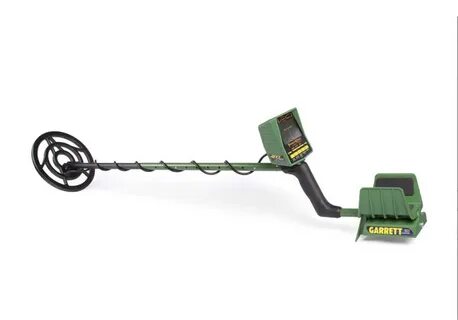

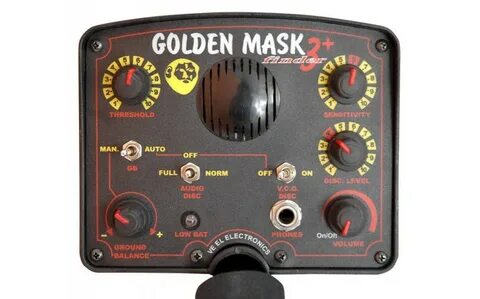

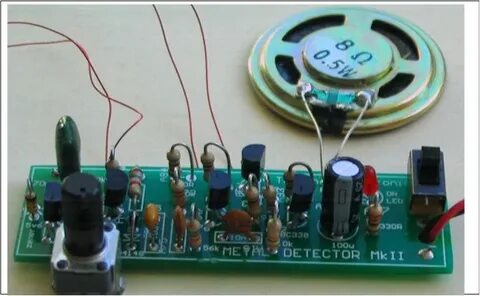

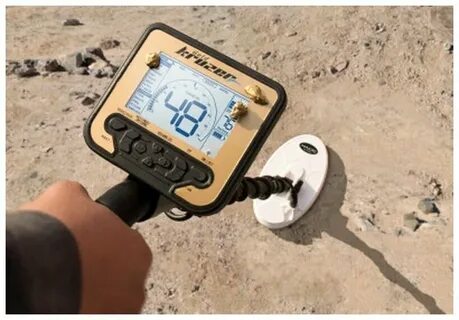

مكونات جهاز كشف المعادن: الأجزاء الأساسية ووظائفها

مكونات جهاز كشف المعادن: الأجزاء الأساسية ووظائفها يعتبر جهاز كشف المعادن من الأجهزة الحديثة التي تستخدم في العديد من المجالات، وتتكون هذه الأجهزة من مجمو…

-

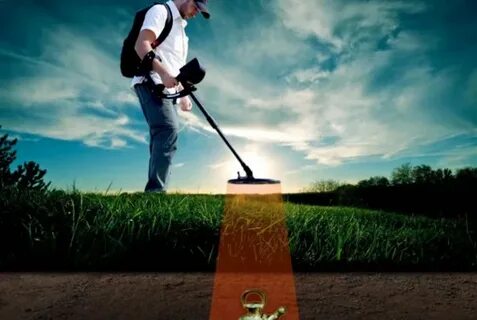

كيفية اكتشاف واستخراج الذهب تحت الأرض: الطرق والتقنيات المستخدمة

كشف الذهب تحت الأرض هو عملية مهمة ومعقدة تتطلب استخدام العديد من الطرق والتقنيات المتقدمة. يعتبر البحث عن واستخراج الذهب من تحت سطح الأرض مهمة صعبة ومعقدة…

-

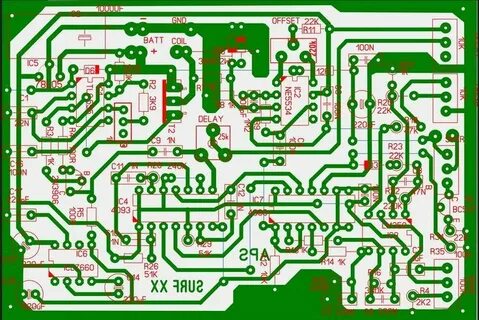

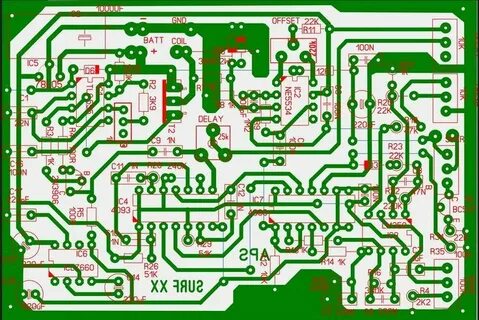

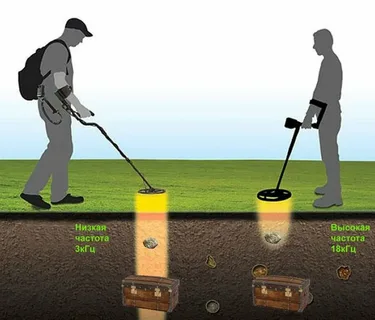

تصميم وفكرة عمل جهاز كشف المعادن: تقنية الكشف عن المعادن

فكرة عمل جهاز كشف المعادن تعتبر من الإبداعات الهندسية التي تهدف إلى استخدام التكنولوجيا في اكتشاف وتحديد مواقع المعادن بطريقة دقيقة وفعالة. تعتمد هذه التقن…

-

تحليل عيوب جهاز تيتان جير 1000: هل يستحق الاستثمار؟

عيوب جهاز تيتان جير 1000 يعتبر جهاز تيتان جير 1000 واحدًا من أشهر الأجهزة المستخدمة في مجال الرياضة واللياقة البدنية. ولكن مع ذلك، هناك بعض العيوب التي يجب…

-

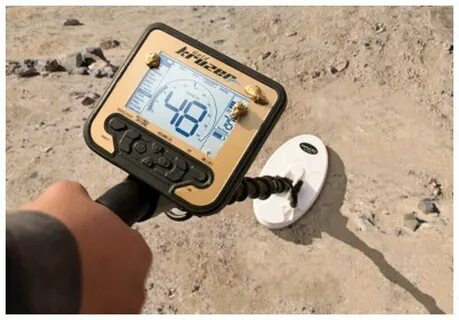

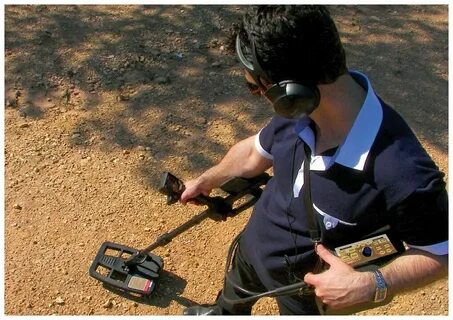

كيفية استخدام جهاز كشف الذهب بكفاءة ودقة

طريقة استخدام جهاز كشف الذهب يعتبر جهاز كشف الذهب من الأدوات الحديثة التي تستخدم في البحث عن الكنوز والمعادن الثمينة. وبالرغم من أنه قد يبدو معقدًا في البد…

-

كيف تكتشف الذهب يدويا: أفضل الطرق والأساليب المجربة

طرق كشف الذهب يدويا هي عملية مهمة للعديد من الأشخاص المهتمين بالبحث والتنقيب عن الذهب. فمن المهم معرفة الطرق الصحيحة للكشف عن الذهب يدويا والتي تضمن نتائج…

-

كيف يعمل جهاز كشف الآثار وأهميته في حفظ التاريخ

صور جهاز كشف الاثار يعتبر جهاز كشف الآثار أحد الأدوات الحديثة والمتطورة التي تستخدم في علم الآثار للكشف عن المخلفات الأثرية والتاريخية تحت سطح الأرض. فهو…

-

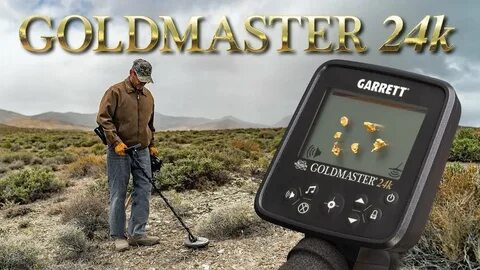

تطور في صناعة كاشف الذهب بإمكانية الكشف عن الذهب على عمق أكثر من متر

صناعة كاشف الذهب عمق أكثر من متر تعتبر صناعة كاشف الذهب من أهم الصناعات التي تساهم في اكتشاف الثروات الطبيعية والتنقيب عن المعادن الثمينة مثل الذهب. ومع ت…

-

أهمية تطوير شكل جهاز كشف الآثار في العالم العربي

أهمية تطوير شكل جهاز كشف الآثار في العالم العربي يعتبر تطوير جهاز كشف الآثار أمراً بالغ الأهمية في العالم العربي، نظراً للثروات الأثرية الهائلة التي يمتلك…

-

سعر جهاز جراوند نافيجيتور: أهم العوامل التي يجب أخذها بعين الاعتبار قبل الشراء

سعر جهاز جراوند نافيجيتور: أهم العوامل التي يجب أخذها بعين الاعتبار قبل الشراء يعتبر سعر جهاز جراوند نافيجيتور أحد العوامل الرئيسية التي يجب النظر إليها ق…

-

سعر جهاز تيتان جير 400: كل ما تحتاج معرفته

سعر جهاز تيتان جير 400: كل ما تحتاج معرفته يعتبر جهاز تيتان جير 400 واحدًا من أحدث الأجهزة الإلكترونية التي أثارت اهتمام الكثيرين بسبب مواصفاته العالية وأ…

-

سعر جهاز rover c4: كل ما تحتاج لمعرفته قبل الشراء

سعر جهاز rover c4: كل ما تحتاج لمعرفته قبل الشراء إذا كنت تبحث عن معلومات حول سعر جهاز روفر C4 الذي يعتبر واحدا من أحدث التكنولوجيات في السوق، فأنت في المك…

-

سعر جهاز QZ80: كيف يمكنك الحصول عليه بأفضل سعر؟

سعر جهاز QZ80: كيف يمكنك الحصول عليه بأفضل سعر؟ إذا كنت تبحث عن الحصول على جهاز QZ80 بأفضل سعر ممكن، فأنت في المكان المناسب. يعتبر جهاز QZ80 واحداً من أفض…

-

أهمية دائرة كاشف المعادن في الكشف والحماية

دائرة كاشف المعادن تعتبر من الأجهزة الحديثة التي تستخدم في الكشف عن المعادن والتحقق من وجودها في الأماكن المختلفة. تلعب هذه الدائرة دوراً كبيرا في الحفاظ ع…

-

تقنية جيو سونار 3D: تطور مذهل في علوم البحار والأبحاث البحرية

تقنية جيو سونار 3D: تطور مذهل في علوم البحار والأبحاث البحرية تعتبر تقنية جيو سونار 3D من أحدث التطورات في مجال علوم البحار والأبحاث البحرية، حيث تمثل قفز…

-

جهاز وحش الذهب الاصلي: كيف يمكن لجهاز الكشف عن الذهب أن يغير حياتك؟

إذا كنت تبحث عن أفضل جهاز للكشف عن الذهب، فإن جهاز وحش الذهب الأصلي هو الخيار الأمثل لك. فهذا الجهاز المبتكر والفعال يمكن أن يكون الحل الأمثل لتحقيق أحلامك…

-

فوائد جهاز ميغا جي 3 في تحسين الأداء الرياضي

جهاز ميغا جي 3 هو جهاز متطور يُستخدم في تحسين الأداء الرياضي وزيادة كفاءة التدريبات البدنية. يُعتبر هذا الجهاز من أحدث التقنيات التي تساهم في تطوير الأداء…

-

جهاز لورنز z1: تقنية متطورة لتحسين أداء الأجهزة الإلكترونية

جهاز لورنز z1: تقنية متطورة لتحسين أداء الأجهزة الإلكترونية تعتبر التقنية من العوامل الأساسية التي تسهم في تطوير العديد من الأجهزة الإلكترونية والتكنولوجي…

-

أهمية جهاز كشف الماس الخام في عمليات التنقيب عن المعادن

جهاز كشف الماس الخام يعتبر جهاز كشف الماس الخام من الأدوات الضرورية في عمليات التنقيب عن المعادن والموارد الطبيعية في الأرض، حيث يلعب دوراً هاما في تحديد…

-

أهمية جهاز كشف الفراغات والمعادن في البحث والتنقيب

جهاز كشف الفراغات والمعادن هو أداة حديثة وفعالة تستخدم في البحث والتنقيب عن الكنوز والمعادن الثمينة. إن استخدام هذا الجهاز يعتبر من أهم الوسائل في عالم الت…

-

أهمية واستخدامات جهاز كشف الذهب غاما في البحث عن الكنوز

جهاز كشف الذهب غاما هو أداة حديثة وفعالة تستخدم في البحث عن الكنوز والمعادن الثمينة، وقد أصبحت أهمية هذا الجهاز لا تُقدر بثمن في عمليات الاستكشاف والتنقيب…

-

أهمية وفوائد جهاز كشف الذهب الخام في عمليات التنقيب والبحث عن الثروات الطبيعية

جهاز كشف الذهب الخام يعتبر أحد الوسائل الحديثة والمهمة في عمليات التنقيب والبحث عن الثروات الطبيعية، حيث يساهم هذا الجهاز في تسهيل وتسريع عمليات البحث عن ا…

-

أهمية استخدام جهاز كشف الذهب GPZ في البحث عن الكنوز

أهمية استخدام جهاز كشف الذهب GPZ في البحث عن الكنوز جهاز كشف الذهب GPZ يعتبر من أحدث التقنيات المستخدمة في الكشف عن الكنوز والمعادن الثمينة، حيث يتميز بالد…

-

أهمية جهاز كشف الأحجار الكريمة في عالم المجوهرات

جهاز كشف الأحجار الكريمة يعتبر أحد الأدوات الحديثة الضرورية في عالم المجوهرات وصناعة المجوهرات، حيث يساهم هذا الجهاز في تحديد نوعية وجودة الأحجار الكريمة ب…

-

جهاز فيشر للكشف عن الذهب: تقنية متطورة للعثور على الكنوز

جهاز فيشر للكشف عن الذهب: تقنية متطورة للعثور على الكنوز يعتبر جهاز فيشر للكشف عن الذهب أحد الأجهزة الحديثة والمتطورة المستخدمة في البحث عن الكنوز والمعاد…

-

فوائد استخدام جهاز فيشر في العلاج الطبي

العلاج الطبي بالاستخدام لجهاز فيشر يعتبر من الطرق الحديثة المتقدمة في مجال الطب البديل والعلاج الطبيعي. يعد جهاز فيشر من أبرز الأجهزة التي تستخدم في علاج ا…

-

فوائد جهاز رويال انالايزر برو في تحليل البيانات وتحسين الأداء

جهاز رويال انالايزر برو هو جهاز متطور يستخدم في تحليل البيانات وتحسين أداء العمل، ويعد من أحدث التقنيات المستخدمة في مجال تحليل البيانات وتحليل الأداء. يتم…

-

جهاز جولد ستيب برو ماكس: تقنية متطورة للكشف عن الذهب والكنوز

جهاز جولد ستيب برو ماكس: تقنية متطورة للكشف عن الذهب والكنوز يُعتبر جهاز جولد ستيب برو ماكس من الأجهزة الحديثة التي تستخدم تقنيات متطورة في مجال كشف الذهب…

-

أهمية جهاز تصوير باطن الأرض في الكشف عن الكنوز والموارد الطبيعية

جهاز تصوير باطن الأرض هو أداة حديثة ومتطورة تستخدم في عمليات البحث عن الكنوز والموارد الطبيعية تحت سطح الأرض. تعتبر هذه التقنية من أهم الوسائل التي تمكننا…

-

أهمية جهاز تصوير الآثار تحت الأرض في البحث والحفاظ على التاريخ

جهاز تصوير الآثار تحت الأرض يعتبر من الأدوات الحديثة والمهمة في البحث والتنقيب عن الآثار الأثرية والتاريخية تحت سطح الأرض. فبفضل التطور التكنولوجي، أصبح بإ…

-

جهاز النحاس للكشف عن الذهب: التقنية الحديثة للعثور على الكنوز

جهاز النحاس لكشف الذهب: التقنية الحديثة للعثور على الكنوز يُعد جهاز النحاس لكشف الذهب واحدًا من الأدوات التي تستخدم في الأنشطة البحثية والأثرية للكشف عن ا…

-

أهمية استخدام جهاز الماني لكشف الذهب في عمليات البحث والتنقيب

جهاز الماني لكشف الذهب هو أداة حديثة ومتطورة تستخدم في عمليات البحث والتنقيب عن الذهب. يعتبر هذا الجهاز من أهم الوسائل التي تساعد على تسهيل عملية اكتشاف ال…

-

جهاز OKM للكشف عن الذهب: تقنية حديثة للبحث عن الكنوز

جهاز OKM لكشف الذهب: تقنية حديثة للبحث عن الكنوز يعتبر جهاز OKM للكشف عن الذهب من أحدث التقنيات المستخدمة في مجال الكشف عن الكنوز والمعادن الثمينة. يتميز…

-

ثمن جهاز ديب سيكر: كيف يمكنك الحصول عليه بسعر مناسب؟

ثمن جهاز ديب سيكر: كيف يمكنك الحصول عليه بسعر مناسب؟ إذا كنت تبحث عن جهاز ديب سيكر وترغب في الحصول عليه بثمن مناسب، فإنك قد وصلت إلى المكان الصحيح. يعتبر…

-

أنواع أجهزة كشف الذهب: دليل شامل لأحدث التقنيات والأدوات المستخدمة

أنواع أجهزة كشف الذهب: دليل شامل لأحدث التقنيات والأدوات المستخدمة يعد البحث عن الذهب واحداً من أكثر الأنشطة إثارة للجدل في عالم الاستكشاف والتنقيب. ومنذ…

-

استخدام الاسياخ النحاسية للكشف عن الذهب: تقنية فعالة وفعالة

يُعتبر استخدام الأسياخ النحاسية للكشف عن الذهب تقنية فعالة وفعالة في مجال التنقيب عن المعادن الثمينة. تعتمد هذه التقنية على استخدام أسياخ مصنوعة من النحاس…

-

استخدام الأسياخ النحاسية لكشف الذهب: تقنية فعالة وموثوقة

استخدام الأسياخ النحاسية لكشف الذهب: تقنية فعالة وموثوقة يعتبر البحث عن الذهب واحداً من أقدم النشاطات التي تمارسها البشرية، وقد استخدم الإنسان العديد من ا…

-

أهمية واستخدامات اجهزة كشف المعادن والفراغات

أجهزة كشف المعادن والفراغات هي أدوات تقنية تستخدم في العديد من المجالات للكشف عن الأشياء المخفية أو الممنوعة. تعتبر هذه الأجهزة ذات أهمية كبيرة في الأمن وا…

-

أهمية اجهزة كشف الفراغات تحت الارض في البحث عن الكنوز

أجهزة كشف الفراغات تحت الأرض تعتبر أدوات حديثة وفعالة في عمليات البحث والتنقيب عن الكنوز والمخفيات الثمينة تحت سطح الأرض. تلعب هذه الأجهزة دوراً بارزاً في…

-

أهمية اجهزة كشف الفراغات في الحفاظ على السلامة

اجهزة كشف الفراغات هي أدوات لها أهمية كبيرة في الحفاظ على السلامة في العديد من المجالات. فهذه الأجهزة تعتبر من الوسائل الحديثة التي تساهم في اكتشاف أي فجوا…

-

جهاز ديب سيكر: تقنية حديثة للحفاظ على الأمان والخصوصية

جهاز ديب سيكر: تقنية حديثة للحفاظ على الأمان والخصوصية يعد جهاز ديب سيكر واحدًا من أحدث التقنيات المتطورة في مجال الأمان والخصوصية. يهدف هذا الجهاز إلى تو…

-

أهمية وفوائد اجهزة كشف المياه الجوفية في البحث عن الموارد المائية

أجهزة كشف المياه الجوفية هي أدوات حديثة تستخدم في البحث عن مصادر المياه الجوفية وتحديد مواقعها بدقة. تعتبر هذه الأجهزة من الأدوات الرئيسية التي تساهم في اس…

-

جهاز كشف الذهب GPX 4500: أسعار منافسة لأفضل أداء

سعر جهاز كشف الذهب GPX 4500 يعتبر من برهان أفضل الأسعار بالمقارنة مع الأداء الرائع لهذا الجهاز. يعد جهاز كشف الذهب GPX 4500 من بين أفضل الأجهزة المتطورة وا…

-

سعر جهاز garrett atx: كل ما تحتاج لمعرفته

سعر جهاز garrett atx: كل ما تحتاج لمعرفته يعتبر جهاز garrett atx واحدًا من أفضل أجهزة الكشف عن المعادن المتقدمة في السوق، ويتميز بقدرته الفائقة على اكتشاف…

-

جهاز جاريت 400: أحدث التقنيات لتحسين الأداء الرياضي

جهاز جاريت 400: أحدث التقنيات لتحسين الأداء الرياضي تعتبر التقنيات الحديثة في مجال الرياضة واللياقة البدنية من أهم العوامل التي تساهم في تحسين أداء الرياض…

-

جهاز الذهب الوحش: تقنية متطورة للكشف عن الذهب والمعادن

يعتبر جهاز الذهب الوحش أحدث التقنيات في مجال الكشف عن الذهب والمعادن. يتميز هذا الجهاز بفعاليته ودقته العالية في رصد الكنوز والمعادن الثمينة تحت الأرض. يعت…

-

سعر وحش الذهب: آخر التطورات والتحديات المتوقعة

سعر وحش الذهب: آخر التطورات والتحديات المتوقعة يعتبر سعر وحش الذهب أحد أهم المواضيع التي يثير اهتمام العديد من الأشخاص في الوقت الحالي. فالذهب يعتبر من ال…

-

أهمية جهاز كشف المياه في الحفاظ على الموارد الطبيعية

أهمية جهاز كشف المياه في الحفاظ على الموارد الطبيعية جهاز كشف المياه هو أداة ضرورية في الحفاظ على الموارد الطبيعية والحفاظ على البيئة بشكل عام. فالمياه تع…

-

أهمية اجهزة الكشف عن المعادن في الأماكن الحيوية

أهمية اجهزة الكشف عن المعادن في الأماكن الحيوية تعتبر اجهزة الكشف عن المعادن من الأدوات الضرورية في العديد من الأماكن الحيوية والمهمة، وتشمل هذه الأماكن ا…

-

اكتشف أحدث أصغر جهاز لكشف الذهب بتقنية حديثة

اصغر جهاز كشف الذهب يعتبر اكتشاف الذهب من أهم الأنشطة التي يقوم بها الكثير من الأشخاص في مختلف أنحاء العالم، سواء لأغراض الترفيه أو لأغراض استثمارية. ومع…

-

جهاز الوحش: تقنية متقدمة لكشف الذهب بدقة وسرعة

جهاز الوحش: تقنية متقدمة لكشف الذهب بدقة وسرعة جهاز الوحش لكشف الذهب هو جهاز يعتمد على تقنية متطورة وحديثة تتيح للمستخدمين كشف الذهب بدقة وسرعة عالية. يعت…

-

كيفية صنع جهاز كشف الذهب بعيد المدى: خطوات وأسرار

كيفية صنع جهاز كشف الذهب بعيد المدى: خطوات وأسرار تعتبر تقنية كشف الذهب بعيد المدى من أحدث التقنيات المستخدمة في البحث عن الكنوز والمعادن الثمينة. ومن خلا…

-

أهمية اجهزة الكشف عن الاثار في عصرنا الحديث

أجهزة الكشف عن الآثار تعتبر من الأدوات الحديثة التي تلعب دوراً مهماً في البحث واكتشاف المواقع الأثرية والتاريخية. ففي عصرنا الحديث، حيث يتسارع التطور التكن…

-

أهمية وفوائد جهاز كشف ذهب في البحث عن الكنوز والمعادن

جهاز كشف ذهب يعتبر جهاز كشف الذهب من الأدوات الحديثة التي تستخدم في البحث عن الكنوز والمعادن الثمينة. يتمتع هذا الجهاز بأهمية كبيرة للباحثين والمنقبين عن…

-

سعر جهاز كشف الذهب GPX 5000: كيفية اختيار العروض المناسبة والتوجيهات الفعالة

سعر جهاز كشف الذهب GPX 5000: كيفية اختيار العروض المناسبة والتوجيهات الفعالة أصبحت تقنية كشف الذهب بواسطة الأجهزة الإلكترونية من أهم وسائل البحث عن الكنوز…

-

أفضل استخدام لـ جولد ستيب برو ماكس في الرياضات الشتوية

جولد ستيب برو ماكس هو منتج مبتكر ومتطور يُستخدم بشكل واسع في مختلف الرياضات الشتوية. يتميز هذا المنتج بفعاليته في حماية الجسم وتقليل الإصابات التي قد تحدث…

-

جهاز كلايزر: التكنولوجيا الحديثة لإزالة الشعر بشكل دائم

جهاز كلايزر: التكنولوجيا الحديثة لإزالة الشعر بشكل دائم إن جهاز كلايزر يعتبر أحدث تقنية لإزالة الشعر بشكل دائم، حيث يعتمد على استخدام الليزر لتدمير بصيلات…

-

وحش الذهب 1000: كيف تحقق ثروة من الاستثمار في الذهب؟

وحش الذهب 1000: كيف تحقق ثروة من الاستثمار في الذهب؟ يعتبر الذهب من أقدم وأثمن العناصر التي يتم استخدامها كمخزون للثروة والاستثمار. ومع تزايد الاهتمام بال…

-

سعر جهاز كشف الذهب GPZ 7000: كيفية الحصول على أدق التقديرات

سعر جهاز كشف الذهب GPZ 7000: كيفية الحصول على أدق التقديرات إذا كنت تبحث عن جهاز كشف الذهب GPZ 7000، فإن الحصول على تقدير دقيق لسعره يعتبر أمرًا مهمًا. يع…

-

كيفية كشف الذهب بدون الحاجة إلى جهاز خاص

كشف الذهب بدون جهاز هو موضوع يثير اهتمام الكثيرين، فالبحث عن الذهب واكتشافه يعتبر من أقدم الهوايات التي تعود إلى العصور القديمة. ورغم تطور التكنولوجيا وظهو…

-

جهاز فحص الذهب: أهمية واستخداماته

جهاز فحص الذهب: أهمية واستخداماته تعتبر الذهب من أهم المعادن الثمينة التي تستخدم في مجموعة واسعة من الصناعات والتطبيقات. ولضمان جودة الذهب وتحديد مدى نقاو…

-

اكتشف أحدث وأصغر جهاز لكشف الذهب اليوم

اكتشف أحدث وأصغر جهاز لكشف الذهب اليوم إذا كنت من هواة البحث عن الذهب والكنوز، فإن اليوم يمكنك الحصول على أحدث وأصغر جهاز لكشف الذهب في السوق. يعتبر هذا ال…

-

أهمية واستخدامات جهاز كشف الذهب 3D في البحث عن الكنوز

جهاز كشف الذهب 3D هو أحد الأدوات الحديثة التي تستخدم في البحث عن الكنوز والمعادن الثمينة في باطن الأرض. يعتبر هذا الجهاز من أهم الأدوات التي تساعد على اكتش…

-

جهاز وحش الذهب 1000 للبيع: احصل على أداء استثنائي ونتائج مذهلة

جهاز وحش الذهب 1000 للبيع: احصل على أداء استثنائي ونتائج مذهلة إذا كنت من هواة البحث عن الذهب والكنوز، فإليك فرصة لامتلاك جهاز وحش الذهب 1000 الذي سيضمن ل…

-

كيف يمكنك كشف الذهب بفعالية ودقة؟

كشف الذهب هو عملية بحث واستكشاف تهدف إلى العثور على ترسبات الذهب بفعالية ودقة. يعتمد الكشف عن الذهب على استخدام تقنيات وأدوات متطورة تمكن من اكتشاف وتحديد…

-

جهاز الذهب: تقنية حديثة للكشف عن الكنوز والمعادن

يعتبر جهاز الذهب أحد الأجهزة الحديثة المتطورة التي تستخدم للكشف عن الكنوز والمعادن بطريقة دقيقة وفعالة. يعمل هذا الجهاز على استخدام تقنيات متطورة في الكشف…

-

أهمية وفوائد اجهزة الكشف عن الذهب في عصرنا الحديث

أجهزة الكشف عن الذهب في بداية المقدمة تعتبر أجهزة الكشف عن الذهب من الأدوات الحديثة التي تلعب دوراً مهماً في عصرنا الحديث، حيث تتوفر في السوق العديد من الأ…

-

أفضل جهاز كشف الذهب الأمريكي: تقييم واختيار الجهاز المثالي للاستخدام

أفضل جهاز كشف الذهب الأمريكي: تقييم واختيار الجهاز المثالي للاستخدام يعتبر البحث عن الذهب واحداً من أقدم أنواع البحث التي قام بها الإنسان، وتطورت طرق البح…

-

كاشف الذهب: تقنية حديثة للعثور على الكنوز الضائعة

كاشف الذهب: تقنية حديثة للعثور على الكنوز الضائعة يعتبر كاشف الذهب واحداً من أهم الأدوات التي تستخدم في البحث عن الكنوز والمعادن الثمينة. فهذه التقنية الح…

-

أهمية ميغا سكان برو في تحسين تجربة المستخدم وزيادة الإنتاجية

ميغا سكان برو هو أحد أهم الأدوات التي تستخدم في تحسين تجربة المستخدم وزيادة الإنتاجية. تعتبر ميغا سكان برو أداة فعالة وضرورية لتحسين أداء الأنظمة وتسريع عم…

-

أهمية كاشف المعادن الصغير في الأمن والسلامة

يعتبر كاشف المعادن الصغير أداة ضرورية في مجال الأمن والسلامة، حيث يساهم في اكتشاف أي أجسام معدنية صغيرة قد تشكل تهديداً للسلامة العامة. تعتمد العديد من الم…

-

جهاز كشف الذهب: مخطط وأساليب فعالة للتنقيب عن الذهب

منذ القدم وحتى يومنا هذا، كان البحث عن الذهب يشكل هدفاً مهماً للكثير من الأشخاص، سواء لأغراض تجارية أو علمية أو حتى ترفيهية. ومع تطور التكنولوجيا والعلوم،…

-

استكشاف عمق جهاز وحش الذهب: تقنية متطورة للبحث عن الكنوز

يعد البحث عن الكنوز أحد الهوايات المثيرة والمشوقة للكثيرين، ولذلك يسعى الكثيرون إلى البحث عن الأجهزة والتقنيات الحديثة التي تساعدهم على اكتشاف الكنوز بسهول…

-

سعر جهاز وحش الذهب: هل يستحق الاستثمار؟

سعر جهاز وحش الذهب: هل يستحق الاستثمار؟ يعتبر جهاز وحش الذهب واحداً من أقوى أجهزة الكشف عن الذهب في السوق، ولكن مع سعره الباهظ يثار التساؤل حول ما إذا كان…

-

سعر جهاز ديب سيكر: كيف تحصل على أفضل عرض؟

سعر جهاز ديب سيكر: كيف تحصل على أفضل عرض؟ يعتبر جهاز ديب سيكر واحدًا من أفضل الأجهزة المتخصصة في تنقية البشرة وتحسين مظهرها. ومع ارتفاع شعبيته وفاعليته ال…

-

أسعار جهاز exp 6000: كل ما تحتاج معرفته قبل الشراء

سعر جهاز exp 6000: كل ما تحتاج معرفته قبل الشراء إذا كنت تبحث عن جهاز exp 6000 وترغب في معرفة المزيد عن أسعاره والمواصفات التي يقدمها، فأنت في المكان المن…

-

أهمية جي بي اكس 4500 في تطوير التكنولوجيا الحديثة

جي بي اكس 4500 هو جهاز ضروري لتطوير التكنولوجيا الحديثة في العديد من المجالات. يعتبر جي بي اكس 4500 أحدث تقنية في مجالات الاتصالات ونقل البيانات، وهو يساهم…

-

أهمية جهاز كشف المعادن والآثار في عصرنا الحديث

جهاز كشف المعادن والآثار هو أداة تقنية حديثة يتم استخدامها بشكل واسع في مجالات متعددة بما في ذلك الأمن والحفاظ على التراث الثقافي. يعتبر هذا الجهاز من أهم…

-

أهمية واستخدامات جهاز كشف الفراغات تحت الأرض

جهاز كشف الفراغات تحت الأرض هو أداة حديثة تستخدم في الكشف عن الفراغات والأنفاق والأنابيب والكابلات تحت سطح الأرض. يعتبر هذا الجهاز من الأدوات الضرورية في ا…

-

أهمية واستخدامات جهاز كشف الآثار تحت الأرض

إن جهاز كشف الآثار تحت الأرض يعتبر أداة حديثة ومهمة في مجال البحث الأثري والتنقيب عن الآثار والكنوز التاريخية. فهذا الجهاز يستخدم تقنيات حديثة ومتطورة للكش…

-

أهمية جهاز كشف الآثار في عمليات البحث الأثري

جهاز كشف أثار يعتبر جهاز كشف الآثار أداة أساسية في عمليات البحث الأثري، حيث يساهم في اكتشاف وتحديد المواقع الأثرية والتنقيب عن الآثار بشكل فعال ودقيق. فهو…

-

جهاز جي بي اكس 5000: الحل الفعال لتحسين أداء الأجهزة الإلكترونية الخاصة بك

جهاز جي بي اكس 5000: الحل الفعال لتحسين أداء الأجهزة الإلكترونية الخاصة بك إذا كنت تعاني من مشاكل في أداء أجهزتك الإلكترونية، فإن جهاز جي بي اكس 5000 قد ي…

-

جهاز جي بي اكس 4500: تقنية حديثة لزيادة كفاءة الأداء وتحسين الاتصالات

جهاز جي بي اكس 4500: تقنية حديثة لزيادة كفاءة الأداء وتحسين الاتصالات جهاز جي بي اكس 4500 هو جهاز متطور يستخدم في تحسين الاتصالات وزيادة كفاءة الأداء في م…

-

جهاز انفينيو برو: تقنية مذهلة لتحسين جودة الصور الفوتوغرافية

جهاز انفينيو برو: تقنية مذهلة لتحسين جودة الصور الفوتوغرافية تعتبر تقنية جهاز انفينيو برو من أحدث التقنيات المبتكرة في مجال تحسين جودة الصور الفوتوغرافية….

-

أهمية جهاز المعادن في الكشف والبحث عن الكنوز والمخلفات الحربية

يعتبر جهاز المعادن أحد الأدوات الحديثة التي تستخدم في الكشف والبحث عن الكنوز والمخلفات الحربية. يعتمد هذا الجهاز على تقنيات متطورة لكشف الأجسام المعدنية ال…

-

جهاز الكشف عن الفراغات: تقنية حديثة لتحديد المواقع الخالية

جهاز الكشف عن الفراغات: تقنية حديثة لتحديد المواقع الخالية تعتبر تقنية جهاز الكشف عن الفراغات من أحدث التقنيات التي تستخدم في تحديد المواقع الخالية في الأ…

-

استعراض جهاز Teknetics T2: تقنية متطورة للكشف عن الذهب والمعادن

جهاز Teknetics T2: تقنية متطورة للكشف عن الذهب والمعادن يعتبر جهاز Teknetics T2 من أحدث الأجهزة المستخدمة في الكشف عن الذهب والمعادن، حيث يتميز بتقنيات مت…

-

جهاز GPZ7000: تقنية متقدمة للكشف عن الذهب والمعادن

جهاز GPZ7000: تقنية متقدمة للكشف عن الذهب والمعادن يعتبر جهاز GPZ7000 أحد أحدث التقنيات في مجال البحث والكشف عن الذهب والمعادن، حيث يتميز هذا الجهاز بالدق…

-

أنواع أجهزة الكشف عن الآثار: تقنيات متطورة للكشف عن آثار دفنية

انواع أجهزة الكشف عن الآثار: تقنيات متطورة للكشف عن آثار دفنية يعد الكشف عن الآثار من الجوانب الهامة في علم الآثار، حيث تعتمد عمليات البحث والتنقيب عن الآ…

-

أفضل الطرق للعثور على أرخص جهاز كشف المعادن في السوق

أرخص جهاز كشف المعادن: البحث عن الجهاز المثالي بأفضل الطرق يعد البحث عن جهاز كشف المعادن بأسعار مناسبة من بين التحديات التي تواجه الكثير من الأشخاص الراغبي…

-

تقنية متطورة: احدث جهاز لكشف الذهب في العالم

تقنية متطورة: احدث جهاز لكشف الذهب في العالم تعتبر التكنولوجيا والتطور العلمي من العوامل الرئيسية التي تؤدي إلى تحقيق الكثير من الإنجازات والابتكارات في م…

-

أحدث جهاز كشف المعادن: التكنولوجيا الحديثة للكشف عن المعادن

أحدث جهاز كشف المعادن: التكنولوجيا الحديثة للكشف عن المعادن يعد جهاز كشف المعادن من الأدوات الحيوية التي تستخدم في مجموعة متنوعة من المجالات مثل الأمن والس…

-

تقنية متطورة: أحدث جهاز كشف الآثار يحدث ثورة في علم الآثار

احدث جهاز كشف الاثار تقنية متطورة: أحدث جهاز كشف الآثار يحدث ثورة في علم الآثار في عالم الآثار، تعتبر التقنيات المتطورة أمراً حاسماً للكشف عن الآثار والتح…

-

أهمية اجهزه كشف الاثار في عمليات البحث والتنقيب

اجهزه كشف الاثار تمثل أدوات حيوية في عمليات البحث والتنقيب عن الآثار الأثرية والتاريخية. فهي تعتبر عنصراً أساسياً في تحديد مواقع الآثار وتحديد مواقع الحفائ…

-

أهمية وفاعلية اجهزة كشف الاثار تحت الارض في البحث العلمي

أجهزة كشف الآثار تحت الأرض تعد من أهم الأدوات في البحث العلمي، حيث تسهم في كشف الآثار والمخلفات التاريخية والأثرية التي تكون مدفونة في باطن الأرض. تعتبر هذ…

-

أهمية وفوائد اجهزة الكشف عن الاثار تحت الارض

أصبحت أجهزة الكشف عن الآثار تحت الأرض من الأدوات الحديثة والمهمة في مجال الأبحاث الأثرية والتاريخية. فهذه الأجهزة تقدم فوائد كبيرة في اكتشاف وتوثيق الآثار…

-

أهمية اجهزة التنقيب عن الآثار في حفظ التاريخ والثقافة

اجهزة التنقيب عن الآثار هي وسائل حديثة ومتطورة تستخدم في عمليات البحث والكشف عن الآثار القديمة والتاريخية في مواقع مختلفة. تعتبر هذه الأجهزة ذات أهمية كبير…

-

تقييم سعر جهاز جي بي زد 7000: هل يستحق الاستثمار؟

تقييم سعر جهاز جي بي زد 7000: هل يستحق الاستثمار؟ يعتبر سعر جهاز جي بي زد 7000 من أهم العوامل التي ينظر إليها عند البحث عن جهاز استقبال الإشارات الاقمار ا…

-

أفضل جهاز لكشف المعادن: كيف تختار الجهاز المناسب لاحتياجاتك؟

أفضل جهاز لكشف المعادن: كيف تختار الجهاز المناسب لاحتياجاتك؟ تعتبر تقنية كشف المعادن أمراً ضرورياً في العديد من المجالات مثل الأمن والتنقيب عن الكنوز والت…

-

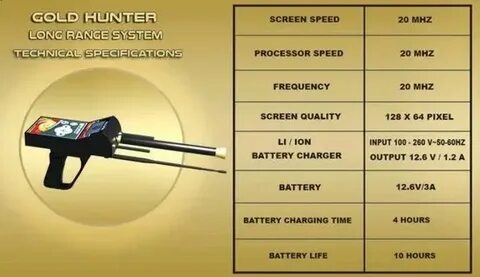

جهاز جولد هانتر: أداة فعالة للبحث عن الكنوز والمعادن

جهاز جولد هانتر: أداة فعالة للبحث عن الكنوز والمعادن يعتبر جهاز جولد هانتر من الأدوات الحديثة والمتطورة التي تستخدم في البحث عن الكنوز والمعادن الثمينة. ي…

-

جهاز جولد ستينجر: تقنية متطورة للكشف عن الكنوز والمعادن

جهاز جولد ستينجر: تقنية متطورة للكشف عن الكنوز والمعادن يعتبر جهاز جولد ستينجر واحداً من أحدث التقنيات في مجال الكشف عن الكنوز والمعادن، حيث يتميز بقوته و…

-

جهاز جولد هانتر سمارت: تكنولوجيا حديثة للكشف عن الذهب والمعادن

جهاز جولد هانتر سمارت: تكنولوجيا حديثة للكشف عن الذهب والمعادن جهاز جولد هانتر سمارت هو أحدث التقنيات في مجال الكشف عن الذهب والمعادن، حيث يتميز بالدقة الع…

-

أفضل جهاز كشف المعادن: اختيار الجهاز المثالي لاحتياجاتك

أفضل جهاز كشف المعادن: اختيار الجهاز المثالي لاحتياجاتك إذا كنت تبحث عن أفضل جهاز كشف المعادن، فإنك حتمًا تعرف أهمية العثور على الجهاز المناسب لاحتياجاتك….

-

جهاز gpx 5000 للبيع: أفضل اختيار للباحثين عن الكنوز

جهاز GPX 5000 للبيع: أفضل اختيار للباحثين عن الكنوز إذا كنت من هواة البحث عن الكنوز والمعادن الثمينة، فإن جهاز GPX 5000 هو الخيار الأمثل لك. يعتبر هذا الج…

-

أحدث جهاز لكشف الذهب: تقنية متطورة للبحث عن الكنوز

أحدث جهاز لكشف الذهب: تقنية متطورة للبحث عن الكنوز في عالم البحث عن الثروات الطبيعية والكنوز التاريخية، تتقدم التقنية بخطى سريعة نحو التطور والتحسين المست…

-

جهاز وحش الذهب 1000: تقنية متطورة لاكتشاف الذهب والثروات الأخرى

جهاز وحش الذهب 1000: تقنية متطورة لاكتشاف الذهب والثروات الأخرى يعتبر جهاز وحش الذهب 1000 من أحدث التقنيات في مجال اكتشاف الذهب والثروات الأخرى. فهو جهاز…

-

أجهزة كشف الذهب والكنوز: تقنيات حديثة للعثور على الكنوز المفقودة

أجهزة كشف الذهب والكنوز: تقنيات حديثة للعثور على الكنوز المفقودة تعتبر أجهزة كشف الذهب والكنوز من الأدوات الحديثة التي تساهم في العثور على الكنوز والمخفيا…

-

جهاز جاريت ابيكس: تقنية متطورة لتحسين أداء الجهاز الرياضي

جهاز جاريت ابيكس: تقنية متطورة لتحسين أداء الجهاز الرياضي يعتبر جهاز جاريت ابيكس واحدًا من أحدث التقنيات في مجال الأجهزة الرياضية، حيث يتميز هذا الجهاز بق…

-

اكتشف أحدث اجهزة كشف الذهب والكنوز الدفينة بتقنيات متطورة

يعتبر البحث عن الذهب والكنوز الدفينة من الهوايات المثيرة للاهتمام والتي تشد انتباه الكثيرين، لذا يسعى الكثيرون دائمًا لاكتشاف أحدث التقنيات والأجهزة التي ت…

-

أهمية اجهزة كشف الاثار في الحفاظ على التاريخ

أجهزة كشف الآثار تعتبر أدوات حديثة وفعالة في الكشف عن المواقع الأثرية والتنقيب عن الآثار التاريخية، وتلعب دوراً هاماً في الحفاظ على التاريخ والتراث الثقافي…

-

فوائد ومميزات جهاز تيتان جير 1000: كل ما تحتاج لمعرفته

جهاز تيتان جير 1000 هو أحدث ابتكار في مجال التكنولوجيا الحديثة والصحة والعناية الشخصية. يعتبر هذا الجهاز منتجاً رائداً في مجال تحسين الحياة اليومية والعناي…

-

الذهب وحش يدهس 7000 في منجمهم: كيف تغزوا الشركة؟

وحش الذهب 7000 في بداية المقدمة أصبح منجم الذهب الواقع في العمق السفلي للأرض مقصداً للكثير من الباحثين عن الثروة والثراء، ولكنه أيضاً أصبح موطناً لواحد من…

-

جهاز كشف الذهب والكنوز القديمة: أهمية استخدامه في التنقيب عن الآثار

جهاز كشف الذهب والكنوز القديمة هو أداة حديثة تستخدم في التنقيب عن الآثار والكنوز القديمة، وهو جهاز يساعد على اكتشاف المعادن الثمينة والكنوز الأثرية التي تع…

-

أهمية وفوائد جهاز الكشف عن الآثار في البحث الأثري

جهاز الكشف عن الآثار هو أداة أساسية في عمليات البحث الأثري، حيث يساعد على اكتشاف وتحديد المواقع التي تحتوي على آثار تاريخية وثقافية. يعد هذا الجهاز من أهم…

-

جهاز كشف الذهب المستعمل للبيع بسعر مغري

إذا كنت تبحث عن فرصة لشراء جهاز كشف الذهب المستعمل بسعر مغري، فأنت في المكان لدينا جهاز وحش الذهب المستعمل للبيع، وهو جهاز يعتبر من أفضل الأجهزة في مجال ك…

-

أحدث جهاز كشف الذهب: تقنية متطورة للكشف عن الثروات السرية

أحدث جهاز كشف الذهب: تقنية متطورة للكشف عن الثروات السرية تعتبر تقنية كشف الذهب من أهم التقنيات المستخدمة في استكشاف الثروات الطبيعية والتي تساهم في تحديد…

-

أهمية واستخدامات اجهزة البحث عن الذهب في العصر الحديث

اجهزة البحث عن الذهب في العصر الحديث تعتبر اجهزة البحث عن الذهب من أهم الأدوات التي تستخدم في عمليات البحث عن الكنوز والثروات الطبيعية في العصر الحديث. فب…

-

أفضل خيارات لشراء جهاز كشف الذهب المناسب لك

شراء جهاز كشف الذهب إذا كنت تبحث عن جهاز كشف الذهب المناسب لك، فأنت في المكان الصحيح. يعتبر شراء جهاز كشف الذهب قراراً مهماً يتطلب الكثير من البحث والتفكير…

-

فوائد واستخدامات الة كشف المعادن في الحياة اليومية

الة كشف المعادن هي جهاز تقني يستخدم للكشف عن وجود المعادن في الأشياء المختلفة. وتتضمن فوائد واستخدامات الة كشف المعادن العديدة التي تؤثر بشكل كبير على حياة…

-

تقنيات كشف المعادن: أساليب وأهمية في الأمن والسلامة

تقنيات كشف المعادن: أساليب وأهمية في الأمن والسلامة يعتبر كشف المعادن من الأساليب الرئيسية في ضمان الأمن والسلامة في مختلف المجالات والمنافذ العامة. فهو ي…

-

أحدث تقنيات اجهزة كشف الذهب التصويرية وفوائدها الكبيرة

اجهزة كشف الذهب التصويرية هي تقنية حديثة ومتطورة تستخدم في الكشف عن معادن الذهب والكنوز تحت الأرض. تعتبر هذه الأجهزة منتجات تقنية عالية الجودة وتعتمد على ت…

-

أهمية جهاز كشف الآثار في البحث والتنقيب

جهاز كشف الآثار يعتبر أداة حيوية في عمليات البحث والتنقيب عن الآثار والكنوز القديمة. فهو يساعد المحترفين والهواة على اكتشاف المواقع الأثرية واستخراج القطع…

-

جهاز كشف الذهب GPZ 7000 الاصلي: كيفية استخدامه والحصول على أفضل النتائج

جهاز كشف الذهب GPZ 7000 الاصلي هو أحد أفضل الأجهزة المتخصصة في الكشف عن الذهب والمعادن الثمينة. يعتبر هذا الجهاز من أحدث التقنيات في مجال الكشف عن الذهب، و…

-

أهمية كاشف الذهب والمعادن في عصر الاستكشاف الحديث

كاشف الذهب والمعادن يعتبر أداة حيوية في عصر الاستكشاف الحديث، حيث يتم استخدامه في البحث عن الثروات الطبيعية والمعادن الثمينة. فقد أصبح البحث عن الذهب والمع…

-

افضل جهاز كشف الذهب في العالم: اكتشف احدث التقنيات والاجهزة المتقدمة

يعتبر البحث عن الذهب من أقدم الأنشطة التي قام بها الإنسان، ومنذ عصور قديمة كان البحث عن الذهب يتطلب الكثير من الوقت والجهد. ولكن مع تطور التكنولوجيا والتقد…

-

بيع جهاز كشف الذهب مستعمل بسعر مناسب: كيف تقوم بشراء جهاز كشف الذهب المستعمل بكفاءة وثقة

يعتبر بيع جهاز كشف الذهب المستعمل مهمة تتطلب الكثير من الثقة والاهتمام. فإذا كنت تبحث عن شراء جهاز كشف الذهب المستعمل بسعر مناسب، فإنك بحاجة إلى الاهتمام ب…

-

أفضل جهاز كشف الذهب الألماني: تقييم ومقارنة

أفضل جهاز كشف الذهب الماني: تقييم ومقارنة يعتبر البحث عن الذهب والكنوز من الهوايات المثيرة والممتعة التي تشغل اهتمام الكثيرين. ومن أجل تحقيق هذا الهدف، ف…

-

أفضل جهاز كشف الذهب: كيف تختار الجهاز المناسب لاحتياجاتك؟

أفضل جهاز كشف الذهب: كيف تختار الجهاز المناسب لاحتياجاتك؟ يعتبر البحث عن الذهب واحداً من أكثر الهوايات شهرةً وتشويقًا في الوقت الحاضر، ولتحقيق نجاح في هذا…

-

أفضل اجهزة كشف الذهب للبحث عن الكنوز والآثار القديمة

أجهزة كشف الذهب تعتبر أجهزة كشف الذهب من أهم الأدوات التي يستخدمها الباحثون عن الكنوز والآثار القديمة. فهي تساعد في تحديد مواقع وجود الذهب والمعادن الثمين…

-

أفضل محلات بيع جهاز كشف المعادن: دليلك لاختيار أفضل الأجهزة والعروض

محلات بيع جهاز كشف المعادن هي الوجهة المثالية للبحث عن أفضل الأجهزة والعروض التي تناسب احتياجات العملاء. تُعد تلك المحلات المتخصصة مكانًا مثاليًا لاختيار ا…

-

كل ما تحتاج معرفته حول سعر جهاز وحش الذهب 1000

سعر جهاز وحش الذهب 1000 هو موضوع يثير اهتمام الكثيرين في عالم التقنية والأجهزة الذكية. إذا كنت تبحث عن معلومات حول هذا الجهاز الرائع والمتطور، فأنت في المك…

-

تعرف على سعر جهاز روفر سي 4 ومميزاته

سعر جهاز روفر سي 4 هو أحدث نسخة من جهاز الروفر الذكي الذي يعمل بتقنية الذكاء الصناعي ويتميز بإمكانيات متقدمة تجعلها من أفضل الخيارات في فئته. يتضمن الجهاز…

-

أهمية مراعاة سعر جهاز الكشف عن المعادن قبل الشراء

أهمية سعر جهاز الكشف عن المعادن قبل الشراء يعتبر سعر جهاز الكشف عن المعادن أحد العوامل الرئيسية التي يجب مراعاتها قبل الشراء، حيث يلعب دوراً مهماً في تحدي…

-

سعر جهاز الكشف عن الآثار: أهم العوامل التي يجب مراعاتها قبل الشراء

سعر جهاز الكشف عن الآثار: أهم العوامل التي يجب مراعاتها قبل الشراء يعتبر جهاز الكشف عن الآثار أداة أساسية للباحثين والمهتمين بالتاريخ والآثار، حيث يمكنهم…

-

سعر جهاز gpx 5000: كل ما تحتاج معرفته قبل الشراء

سعر جهاز gpx 5000: كل ما تحتاج معرفته قبل الشراء إذا كنت تبحث عن جهاز كشف الذهب الخام مناسب، فإن جهاز gpx 5000 قد يكون الخيار المثالي لك. يعتبر هذا الجهاز…

-

أهمية جهاز كشف المعادن في الأماكن العامة والخاصة

جهاز كشف المعادن يعتبر أحد الأدوات الحديثة التي تستخدم لضمان الأمان والحماية في الأماكن العامة والخاصة. إنه جهاز يمكن استخدامه في مختلف البيئات للكشف عن ال…

-

أهمية استخدام جهاز لكشف المعادن في البحث والأمن العام

يعد جهاز لكشف المعادن من الأدوات الحديثة التي يتم استخدامها بشكل واسع في البحث والأمن العام، حيث يعتبر هذا الجهاز أداة ضرورية للكشف عن المعادن والمواد الخط…

-

جهاز كشف الفراغات: أسهل طريقة لاكتشاف الأشياء المفقودة

ببساطة، يعد جهاز كشف الفراغات أحد أكثر الأدوات فعالية في البحث عن الأشياء المفقودة. يمكن استخدام هذا الجهاز للعثور على الأشياء التي تم فقدها في المناطق الض…

-

أهمية جهاز كشف الذهب garrett في البحث عن الكنوز

أهمية جهاز كشف الذهب garrett في البحث عن الكنوز يعتبر جهاز كشف الذهب garrett أحد الأدوات الهامة في عملية البحث عن الكنوز والدفائن في الأرض. فهو يعتبر وسيل…

-

أهمية جهاز كشف الدفائن والكنوز في البحث والاكتشاف

جهاز كشف الدفائن والكنوز هو أداة مهمة في عمليات البحث والاكتشاف، حيث يساعد في الكشف عن الكنوز والمخفيات تحت الأرض بشكل سريع ودقيق. يستخدم هذا الجهاز في مخت…

-

جهاز صغير لكشف الذهب: تقنية حديثة للبحث والاكتشاف

جهاز صغير لكشف الذهب: تقنية حديثة للبحث والاكتشاف تعتبر تقنية الكشف عن الذهب والمعادن من أهم التقنيات في مجال البحث والاستكشاف، حيث تسهم في اكتشاف الكنوز…

-

جهاز جيبارد جي بي ار: تقنية متطورة لتتبع المواقع والأنشطة الخارجية

جهاز جيبارد جي بي ار: تقنية متطورة لتتبع المواقع والأنشطة الخارجية يعتبر جهاز جيبارد جي بي ار واحدًا من أحدث التقنيات المتقدمة في مجال تتبع المواقع والأنش…

-

أهمية واستخدامات جهاز التنقيب في البحث العلمي والتنقيب عن الآثار

جهاز تنقيب هو أداة أساسية في البحث العلمي والتنقيب عن الآثار، حيث يُستخدم لاكتشاف ودراسة الآثار الأثرية والمعالم الأثرية والمعادن والموارد الطبيعية. ويعتبر…

-

أهمية جهاز الكشف عن المعادن والذهب في البحث والتنقيب

جهاز الكشف عن المعادن والذهب هو أداة لا غنى عنها في عمليات البحث والتنقيب عن المعادن الثمينة والكنوز الضائعة. يعتبر هذا الجهاز من أهم الأدوات التقنية التي…

-

تجربة جهاز كشف الذهب: هل يمكنك الاعتماد عليه؟

تجربة جهاز كشف الذهب: هل يمكنك الاعتماد عليه؟ يعد جهاز كشف الذهب من الأدوات الحديثة التي تستخدم في البحث عن الذهب والمعادن الثمينة، وقد أصبحت هذه الأجهزة…

-

أنواع جهاز كشف المعادن: الخيارات المثالية لاحتياجاتك

أنواع جهاز كشف المعادن: الخيارات المثالية لاحتياجاتك يعد جهاز كشف المعادن من الأدوات الحديثة التي تستخدم في العديد من المجالات مثل الأمن والحفاظ على السلا…

-

أهمية وأنواع اجهزة الكشف عن المعادن

أنواع اجهزة الكشف عن المعادن تعتبر أجهزة الكشف عن المعادن من الأدوات الحديثة التي تستخدم في العديد من المجالات، سواء في البحث والتنقيب عن الكنوز والآثار ال…

-

آلة تنقيب عن الذهب: أساليب وتقنيات للعثور على الكنوز

الة تنقيب عن الذهب هي جهاز يستخدم للبحث عن معادن الذهب في الأرض. تعتبر عملية البحث عن الذهب من العمليات الصعبة والمعقدة، وتتطلب استخدام تقنيات متقدمة وأسال…

-

أهمية الة الكشف عن المعادن في البحث والأمن

أهمية الة الكشف عن المعادن في البحث والأمن الية الكشف عن المعادن تعتبر أداة حيوية في مجالات البحث والأمن، حيث تساهم في التحقق من وجود المواد الضارة وغير ا…

-

أفضل جهاز كاشف ذهب في العالم: تقييم ومقارنة لأحدث التقنيات المتوفرة

لا شك أن البحث عن الذهب والمعادن الثمينة يعتبر من أقدم الأنشطة التي يمارسها الإنسان. ومنذ فجر التاريخ، ابتكر الإنسان العديد من الأدوات والأجهزة للبحث عن هذ…

-

أحدث تقنية: اصغر جهاز كشف عن الذهب متوفر الآن في الأسواق

أصغر جهاز كشف عن الذهب هو أحدث تقنية متوفرة الآن في الأسواق، وهو جهاز يعتمد على أحدث التقنيات الحديثة في مجال الكشف عن الذهب. يتميز هذا الجهاز بصغر حجمه وخ…

-

أفضل جهاز لكشف المعادن: دليل لاختيار الجهاز المناسب

أفضل جهاز لكشف المعادن: دليل لاختيار الجهاز المناسب إذا كنت تبحث عن أفضل جهاز لكشف المعادن، فأنت في المكان الصحيح. يعد كشف المعادن أمرًا مهمًا في العديد م…

-

كيف تختار أحسن جهاز كشف المعادن لاحتياجاتك؟

احسن جهاز كشف المعادن هو أداة أساسية للعديد من المجالات مثل الأمن والبناء والبحث عن الكنوز والهواة. ولكن اختيار أفضل جهاز كشف معادن يمكن أن يكون تحديًا بال…

-

أجهزة ذهب: التكنولوجيا والابتكار في عالم الكنوز

اجهزة ذهب: التكنولوجيا والابتكار في عالم الكنوز تعتبر الكنوز والثروات القديمة من أكثر الأشياء إثارة للدهشة والفضول، حيث يبحث الناس منذ القدم عن الكنوز الم…

-

أهمية واستخدامات اجهزة البحث عن الاثار في الآثار القديمة

مقدمة: تعتبر أجهزة البحث عن الآثار من الأدوات والتقنيات الحديثة التي تستخدم في الكشف عن الآثار والمخلفات القديمة، وتعتبر هذه الأجهزة أدوات ضرورية لدراسة وا…

-

أهمية اجهزه كشف المعادن والذهب في البحث والاكتشاف

أهمية اجهزه كشف المعادن والذهب في البحث والاكتشاف اجهزه كشف المعادن والذهب تعتبر أدوات حيوية في عمليات البحث والاكتشاف، حيث تساهم في تسهيل عملية البحث عن ا…

-

أهمية جهاز كشف الكنوز تحت الأرض في الاستكشاف والتنقيب

جهاز كشف الكنوز تحت الأرض يعد أداة أساسية في عملية الاستكشاف والتنقيب عن الكنوز والمخفيات الثمينة تحت سطح الأرض. يتميز هذا الجهاز بقدرته على اكتشاف العناصر…

-

أفضل جهاز تنقيب عن الذهب: اكتشاف الثروات تحت الأرض

أفضل جهاز تنقيب عن الذهب: اكتشاف الثروات تحت الأرض يعتبر البحث عن الذهب واحداً من أقدم النشاطات التي قام بها الإنسان، حيث يسعى الكثيرون إلى اكتشاف الثروات…

-

أهمية اجهزة كشف الذهب والمعادن في البحث عن الكنوز

أجهزة كشف الذهب والمعادن هي أدوات حديثة تستخدم في البحث عن الكنوز والمعادن الثمينة تحت سطح الأرض. وتُعتبر هذه الأجهزة من أهم الوسائل التي تساعد على اكتشاف…

-

أهمية وفوائد جهاز كشف الذهب بعيد المدى في البحث عن الكنوز

جهاز كشف الذهب بعيد المدى هو أداة حديثة تستخدم في البحث عن الكنوز والمعادن الثمينة في الأماكن الخارجية. يعتبر هذا الجهاز تقنية متطورة تساعد على تسهيل عملية…

-

أهمية اجهزه كشف المعادن في مجال الأمن والسلامة

اجهزه كشف المعادن في بداية المقدمة تعتبر أجهزة كشف المعادن من الأدوات الحديثة والمهمة في مجال الأمن والسلامة، حيث تستخدم هذه الأجهزة لاكتشاف وكشف أي أجسام…

-

كيف يعمل جهاز كشف الكنوز تحت الأرض؟

يعتبر جهاز كشف الكنوز تحت الأرض أحد الأدوات الحديثة التي تستخدم للبحث عن الكنوز والمخفيات تحت سطح الأرض. يعمل هذا الجهاز عن طريق إرسال إشارات إلكترونية تحت…

-

تحويل الهاتف إلى جهاز كشف الذهب: طريقة بسيطة وفعالة

تحويل الهاتف إلى جهاز كشف الذهب: طريقة بسيطة وفعالة في ظل التقنيات الحديثة واستخدام الهواتف الذكية بشكل يومي، تطورت الطرق التي يمكن من خلالها تحويل الهاتف…

-

أهمية واستخدامات جهاز كشف المعادن والذهب في البحث والتنقيب

جهاز كشف المعادن والذهب هو أداة حديثة وفعالة تستخدم في عمليات البحث والتنقيب عن المعادن والمعادن الثمينة مثل الذهب. يعتبر هذا الجهاز أداة أساسية للكشف عن ا…

-

أهمية جهاز كشف الذهب في عمليات التنقيب عن الكنوز

جهاز لكشف الذهب تعتبر عمليات التنقيب عن الكنوز والثروات الطبيعية من بين أقدم الأنشطة التي قام بها الإنسان منذ القدم. ومن أهم العناصر التي تساهم في نجاح هذه…

-

ماكينة كشف الذهب: أحدث التقنيات والتطورات في عالم البحث عن الثروات

ماكينة كشف الذهب: أحدث التقنيات والتطورات في عالم البحث عن الثروات تعد ماكينة كشف الذهب واحدة من أهم الأدوات التي تستخدم في عمليات البحث عن الثروات الطبيع…

-

أهمية جهاز كشف المعادن تحت الأرض في البحث عن الكنوز

أهمية جهاز كشف المعادن تحت الأرض في البحث عن الكنوز يعتبر جهاز كشف المعادن تحت الأرض أداة فعالة ومهمة في عملية البحث عن الكنوز والمخفيات تحت سطح الأرض. فهو…

-

أفضل أنواع اجهزه كشف الذهب وطرق استخدامها

اجهزه كشف الذهب يعتبر البحث عن الذهب أحد أهم الأنشطة التي تثير اهتمام الكثير من الأشخاص في مختلف أنحاء العالم، سواء كانوا هواة أو محترفين. ولتسهيل هذه الع…

-

أحدث أسعار جهاز كشف الذهب والمعادن في الأسواق

أسعار جهاز كشف الذهب تعتبر من المواضيع المهمة والمثيرة للاهتمام في الوقت الحالي، حيث يبحث الكثير من الأشخاص عن أحدث أسعار وأنواع أجهزة الكشف عن الذهب والمع…

-

أهمية واستخدامات جهاز التنقيب عن الذهب في البحث العلمي والاستكشاف

جهاز التنقيب عن الذهب هو أداة مهمة وضرورية في البحث العلمي والاستكشاف ويعتبر أحد الوسائل الرئيسية لاكتشاف واستخراج الذهب. يتم استخدام هذا الجهاز في البحث ع…

-

أفضل جهاز كشف الذهب الدفع عند الاستلام في السوق

يعتبر جهاز كشف الذهب الدفع عند الاستلام أحد أهم الأدوات المستخدمة في عمليات البحث عن الذهب والمعادن الثمينة. فهو يساعد المستخدمين في تحديد مواقع تواجد الذه…

-

فوائد وأهمية اجهزة كشف المعادن في الحياة اليومية

اجهزة كشف المعادن في بداية المقدمة تعتبر أجهزة كشف المعادن أداة هامة وضرورية في الحياة اليومية، حيث توفر العديد من الفوائد وتحمل أهمية كبيرة في مختلف المج…

-

أهمية جهاز الكشف عن المعادن في الأماكن العامة والخاصة

جهاز الكشف عن المعادن هو أداة تقنية حديثة تستخدم في الأماكن العامة والخاصة لضمان السلامة والأمان. يعتبر هذا الجهاز ضروريًا في الحد من تهديدات الأمان التي ق…

-

أحدث جهاز ذهب يحدث ثورة في صناعة البحث عن الكنوز

جهاز ذهب يحدث ثورة في صناعة البحث عن الكنوز يعتبر البحث عن الكنوز والمخفيات من الهوايات المثيرة التي تشد الكثيرين، ولهذا الغرض تم تطوير أحدث جهاز ذهب يحدث…

-

جهاز البحث عن الذهب: تقنية حديثة لاكتشاف الكنوز تحت الأرض

جهاز البحث عن الذهب: تقنية حديثة لاكتشاف الكنوز تحت الأرض جهاز البحث عن الذهب هو تقنية متطورة وفعالة تستخدم لاكتشاف الكنوز والمعادن الثمينة تحت سطح الأرض….

-

أهمية جهاز تنقيب الذهب في عصر الاستكشاف الحديث

جهاز تنقيب الذهب في بداية المقدمة يعد جهاز تنقيب الذهب أحد الأدوات الحديثة التي تستخدم في عمليات الاستكشاف عن الذهب في العصر الحديث. وتعتبر أهمية هذا الجها…

-

تحقق من سعر جهاز كشف المعادن قبل الشراء: دليل الشراء السريع

سعر جهاز كشف المعادن هو عامل مهم يجب أخذه في الاعتبار قبل شراء الجهاز، حيث يمكن أن يؤثر بشكل كبير على قرار الشراء واختيار الجهاز المناسب. من خلال هذا الدلي…

-

أهمية جهاز الكشف عن الذهب في عمليات التنقيب والبحث

جهاز الكشف عن الذهب يعد أداة حيوية وضرورية في عمليات التنقيب والبحث عن الذهب. فهو يساهم بشكل كبير في تسهيل عملية البحث وتحديد مواقع تواجد الذهب بشكل دقيق و…

-

أفضل 5 أجهزة كشف الذهب بأقل تكلفة في السوق

أرخص جهاز كشف الذهب تعتبر أجهزة كشف الذهب من الأدوات الحيوية في عمليات البحث عن الكنوز والمعادن الثمينة، وتتوفر اليوم العديد من الأجهزة التي تقدم خدمات مم…

-

ما هو سعر جهاز كشف الذهب وأهمية مقارنة الأسعار قبل الشراء

سعر جهاز كشف الذهب إذا كنت تبحث عن جهاز كشف الذهب، فإن الأمر الرئيسي الذي يجب عليك مراعاته هو سعر الجهاز. فعند اتخاذ قرار الشراء، يجب مقارنة الأسعار بين ال…

-

أفضل جهاز كشف الذهب للبيع: اكتشف الكنوز والآثار بسهولة

جهاز كشف الذهب للبيع هو الحل الأمثل للباحثين عن الكنوز والآثار، فهو يوفر لهم فرصة فريدة لاكتشاف الذهب والمعادن الثمينة بسهولة ودقة. وباستخدام هذا الجهاز، س…

-

أهمية جهاز كشف المعادن في الأماكن العامة

جهاز كشف المعادن يعتبر جهاز كشف المعادن أحد الأجهزة الأمنية الضرورية في الأماكن العامة، حيث يساهم في تعزيز الأمان وحماية الحياة والممتلكات. فهو يقوم بتحديد…

-

أهمية جهاز كشف الذهب في عمليات البحث والتنقيب عن الثروات الطبيعية

أهمية جهاز كشف الذهب في عمليات البحث والتنقيب عن الثروات الطبيعية يعد جهاز كشف الذهب أحد أهم الأدوات في عمليات البحث والتنقيب عن الثروات الطبيعية، حيث يسا…

-

Turning Mercury into Gold: The Alchemy of Modern Science

Turning Mercury into Gold: The Alchemy of Modern Science Mercury into gold, two elements that have intrigued alchemists for centuries. The idea of transfo…

-

New Technology Unveiled: Metal Detector Detector Takes Security to the Next Level

Metal detector detector: a new innovation that is revolutionizing security measures. With the increasing need for advanced security solutions, the unveilin…

-

New High-Tech “Detecting Tools” Revolutionize Security Measures

Detecting tools have long been a crucial component of security measures, aiding in the identification and prevention of potential threats. As technological…

-

Exploring the World’s Largest Gold Companies

World’s largest gold companies are a crucial part of the global economy, as gold has always been a valuable and sought-after commodity. With the demand for…

-

Uncovering Hidden Treasures: The Best Metal Detectors for Your Hobby

Metal detectors have long been a fascination for hobbyists and treasure hunters. The thrill of uncovering hidden treasures buried beneath the earth’s surfa…

-

Discovering the World’s Largest Gold Mine: A Profound Gold Find

World’s Largest Gold Mine: A Profound Gold Find The discovery of the world’s largest gold mine has sparked excitement and intrigue among miners, investors…

-

Exploring the World’s Biggest Gold Mine: A Mammoth Discovery

The world’s biggest gold mine has always held a certain allure for adventurers and investors alike. The promise of untold riches and the thrill of discover…

-

Understanding the Dangers of Gold Amalgamation with Mercury

Gold amalgamation with mercury is a common practice used in small-scale gold mining to extract gold from ore. However, the process poses serious health and…

-

Exploring the World’s Largest Gold Mine: A Geological Marvel

The world’s largest gold mine is a geological marvel that has captivated the attention of scientists, miners, and adventurers alike. With its vast expanse…

-

Gold States: Which States Have the Most Gold Reserves?

Gold States: Which States Have the Most Gold Reserves? The United States is known for its wealth of natural resources, including gold. With numerous state…

-

The World’s Biggest Gold Mining Companies Revealed

Biggest gold mining companies around the world play a significant role in the global economy. From exploration to extraction and refining, these companies…

-

Discovering Gold Inside a Rock: A Miner’s Dream Come True

Gold inside a rock is the ultimate dream of every miner. The experience of discovering this precious metal embedded in a seemingly ordinary rock is indeed…

-

Stunning Gold Mine Photos Show Beauty of Mining Operations

Gold mine photos capture the raw beauty and power of mining operations, showcasing the impressive scale and intricate details of the industry. From the stu…

-

Uncovering the Hidden Wealth: Finding Gold in Rock Deposits

Gold in rock deposits has long been a source of fascination and excitement for prospectors and geologists alike. The quest for uncovering the hidden wealth…

-

New Mining Detector Technology Revolutionizes Resource Extraction

Mining Detector Technology Revolutionizes Resource Extraction Advancements in mining detector technology have sparked a revolution in the extraction of va…

-

Exploring the Untapped Potential of a Gold Mine

Gold mine exploration is a fascinating and potentially lucrative endeavor that has captured the imagination of prospectors and investors for centuries. The…

-

Exploration of Gold: Prospecting for Precious Metal in Uncharted Territories

Exploration of Gold: Prospecting for Precious Metal in Uncharted Territories Exploration gold has long been a fascinating endeavor, attracting adventurers…

-

Uncovering Opportunity: The Role of a Mineral Prospector

Mineral prospector: Uncovering Opportunity A mineral prospector plays a vital role in the exploration and development of mineral resources. Their expertis…

-

Exploring the Geology of Gold Deposits in 11 Words

Geology gold enthusiasts, join us in our exploration of gold deposits.

-

Exploring the Secrets of a Gold Mine

Gold has long been the object of fascination and desire, with its shining allure captivating hearts and minds for centuries. One of the most intriguing and…

-

Exploring the Potential of the Gold Mine Industry

Gold, known for its lustrous and valuable properties, has long been a coveted resource in various industries. One such industry that heavily relies on the…

-

Exploring the Geology of Gold Mining: A Fascinating Study

Gold mining and geology are two interconnected fields that have fascinated scientists, miners, and enthusiasts for centuries. The study of the geology of g…

-

Discovering the Riches of Location Gold in California’s Sierra Nevada

Location Gold in California’s Sierra Nevada is known for its rich history and abundance of valuable treasures. The region’s gold mines have long been a sou…

-

Unlocking the Potential: Innovative Techniques to Mine Gold

In today’s competitive mining industry, finding innovative techniques to unlock the potential of gold mining is crucial for success. With the increasing de…

-

Unearthing Riches: The Profit Potential of Gold Mining Bags

Gold mining bags are a symbol of potential riches waiting to be unearthed. In the world of gold mining, these bags represent the possibility of striking it…

-

Uncovering the Untapped Potential: Exploring Gold in a Mine

Gold in a mine has long been a symbol of wealth and prosperity, but there is still much untapped potential waiting to be discovered. In this article, we wi…

-

Uncovering the Best Gold Locations for Prospecting in California

Gold locations in California have long been a source of excitement and opportunity for prospectors. With its rich history of gold mining, the state has bee…

-

Discover the Best Gold Pan Prices on the market today

Gold pan prices are a significant consideration for anyone looking to delve into the world of gold panning. Whether you are a seasoned prospector or a begi…

-

Uncovering the Value of Mining Boxes in today’s Industry

Mining boxes are an essential component in the mining industry, playing a critical role in the transportation and storage of valuable materials. In today’s…

-

Exploring the Abundance of Gold Deposits in the USA

Gold deposits in the USA have long been a topic of fascination and economic significance. The country is rich in natural resources, with vast and varied la…

-

Discover the Latest Minelab Detectors on Their Official Website

Minelab Website: Discover the Latest Minelab Detectors on Their Official Website If you’re in the market for the latest and most advanced metal detectors,…

-

Gold Prospecting for Beginners: A Comprehensive Guide

Gold prospecting for beginners can be an exciting and rewarding adventure for those looking to explore the great outdoors and potentially strike it rich. H…

-

Discover the Basics of Beginner Gold Prospecting

Beginner Gold Prospecting is an exciting and rewarding hobby that allows individuals to search for and extract the valuable mineral, gold. Whether you are…

-

Discover the Top Metal Detector Brands for Your Next Treasure Hunt

Top Metal Detector Brands: Discover the Top Metal Detector Brands for Your Next Treasure Hunt If you’re an avid treasure hunter or a beginner looking to s…

-

Finding The Best Gold Mining Locations Near Me

Mining for Gold Near Me: Finding The Best Gold Mining Locations If you’re looking to embark on a gold mining adventure, you may be wondering where to sta…

-

Top 5 Good Metal Detector Brands for Serious Hobbyists

Good metal detector brands are essential for serious hobbyists who are looking for reliable and high-quality equipment. With so many options available, it…

-

Prospecting for Gold: Tips for Finding Your Fortune

Searching for gold has long been a fascination for many adventurous individuals, and for good reason. The thrill of striking it rich and finding your fortu…

-

US Gold Mining: The Current State and Future Prospects

US Gold Mining: The Current State and Future Prospects US gold mining has been a significant industry for centuries, with the first gold discovery in the…

-

Unlocking the Potential of Gold Exploration: A Promising Venture

Gold exploration is a captivating and promising venture that has the potential to unearth significant economic opportunities. As the demand for gold contin…

-

Uncovering Riches: The Basics of Placer Mining

Placer mining, also known as surface mining, has been a valuable method for uncovering riches from the earth for centuries. In this guide, we will explore…

-

Uncovering Hidden Treasures: The Ultimate Gold Search Guide

Gold search can be an exciting and rewarding hobby for those who are passionate about discovering hidden treasures. In “Uncovering Hidden Treasures: The Ul…

-

Top 5 Metal Detector Brands for All Your Treasure-Hunting Needs

Metal detector brands have become increasingly popular among treasure hunters and enthusiasts. With so many options available, it can be overwhelming to ch…

-

Discover the Top 5 Best Metal Detector Brands of 2021

Are you on the hunt for the best metal detector brands of 2021? Look no In this article, we will explore the top 5 best metal detector brands that are mak…

-

Explore the Best Professional Metal Detectors for Treasure Hunting

Professional Metal Detectors: Explore the Best Options for Treasure Hunting When it comes to treasure hunting and metal detecting, having the right equipm…

-

Unlocking the Power of Mine Lab: A Guide to Metal Detection

Mine Lab is a leading brand in the field of metal detection, known for its innovative technology and high-performance equipment. In this guide, we will exp…

-

Exploring the Latest Innovations in Mining Tools Technology

Mining tools technology has been continuously evolving to enhance efficiency and safety in the mining industry. In this article, we will be exploring the l…

-

Discover the Best Gold Panning Near Me

Gold Panning Near Me: Discover the Best Spots for Finding Gold If you’re looking to try your hand at gold panning, it’s important to find the best locatio…

-

Discovering Nearby Gold Mining Opportunities: A Guide for Locals

Gold mining near me has long been an enticing opportunity for locals looking to capitalize on the abundance of precious metal in their vicinity. Whether yo…

-

Top Gold Mining Companies Set to Expand Operations Globally

Gold mining companies are poised for global expansion as they ramp up their operations to capitalize on the rising demand for gold. With the increasing int…

-

Discover How to Find Gold: A Beginner’s Guide

Are you eager to find gold but not sure where to start? In this beginner’s guide, we will help you discover how to find gold and embark on your own treasur…

-

Upgrading Your Mining Operations with State-of-the-Art Equipment

Mining Equipment: Keeping Your Operations Up-to-Date with State-of-the-Art Gear In the ever-evolving world of mining, staying ahead of the game is crucial…

-

Discovering History: The Best Metal Detectors for Treasure Hunting

Metal detectors have long been used as valuable tools for discovering history and uncovering treasures from the past. Whether you are a passionate treasure…

-

Exploring the Impacts of Gold Mining on Local Communities

Gold mining is a prevalent and influential industry that has significant impacts on local communities in the areas where it operates. This industry not onl…

-

Unveiling the Secret of the Gold Cube: How It Works

Gold Cube Gold has long been a coveted commodity, and the discovery of the gold cube has further fueled the fascination with this precious metal. The intr…

-

Uncover Hidden Treasures with a Gold Pan: A Beginner’s Guide

Gold pan, an essential tool for any aspiring gold miner, has been used for centuries to uncover hidden treasures. In this beginner’s guide, we will explore…

-

Affordable Metal Detector Prices: Finding The Best Deals

Price for a metal detector is always a crucial factor when it comes to purchasing this handy tool. With the wide range of options available in the market,…

-

Unearthing Treasures with the Minelab Gold Monster Metal Detector

Gold Monster Minelab is a revolutionary metal detector that has opened up a world of opportunity for treasure seekers. With its advanced technology and pre…

-

Uncovering Hidden Treasures: The Best Gold Detector Metal for You

Gold detector metal is an essential tool for any treasure hunter or prospector looking to uncover hidden treasures. With so many options available on the m…

-

Exploring the World of Gold Mining and Processing

Gold mining and processing are industries that have been integral to human civilization for centuries. The process of extracting gold from the earth and tu…

-

Uncovering Hidden Treasure: The Best Gold Detector for You

Are you in search of buried treasures waiting to be unearthed? With the modern technology of a gold detector, you can now uncover hidden gold and precious…

-

Uncovering Hidden Treasures: The Power of Gold in Metal Detectors

Gold in metal detector has been a source of fascination and excitement for treasure hunters and metal detecting enthusiasts. The potential to uncover hidde…

-

Unearthing Treasures: The Best Gold & Metal Detectors for 2021

Gold & Metal Detector: Unearthing Treasures in 2021 There’s nothing quite like the thrill of uncovering hidden treasures, and the right gold & metal detec…

-

Exploring the Art of Hand Panning for Gold

Hand panning is a traditional method of gold prospecting that has been practiced for centuries. In this article, we will be exploring the art of hand panni…

-

Top 7 Essential Gold Hunting Tools for Treasure Seekers

Gold hunting tools are essential for treasure seekers who are looking to strike it rich. Whether you are an experienced prospector or a novice looking to t…

-

Uncovering the Best Deals on Metal Detectors: Comparing Prices

Prices on metal detectors can vary greatly, and finding the best deal can be a daunting task. With so many options available, it can be overwhelming to kno…

-

Discover the Best Prospecting Tools for Finding Gold

Prospecting Tools Gold: Are you a gold enthusiast looking to find the best tools for uncovering this precious metal? Whether you’re a seasoned prospector o…

-

Uncovering Hidden Treasures: Gold Detecting Metal Detector Guide

Gold detecting metal detectors are an essential tool for anyone seeking to uncover hidden treasures. In this comprehensive guide, we will explore everythin…

-

The Ultimate Guide to the Minelab Gold Monster

The Minelab Gold Monster is a powerful and advanced metal detector that has been specifically designed for gold prospecting. Whether you are a beginner or…

-

Exploring the Gold Mining Process: From Extraction to Refining

Gold mining process is a complex and fascinating journey that involves various stages, from the initial extraction of gold from the earth to the meticulous…

-

Revolutionizing Gold Mining with Cutting-Edge Machinery

Gold mining machinery has undergone a significant transformation in recent years, with cutting-edge technology revolutionizing the way this precious metal…

-

Uncover Treasure with a Gold and Metal Detector: The Ultimate Guide

Gold and Metal Detector: The Ultimate Guide Are you fascinated by the idea of uncovering hidden treasures buried beneath the ground? If so, a gold and met…

-

Uncovering Hidden Treasures: The Best Metal Detectors for Gold

Metal detectors for gold are essential tools for treasure hunters and prospectors looking to unearth hidden treasures. With the right equipment, gold hunte…

-

Essential Gold Prospecting Tools for Successful Treasure Hunters

Gold prospecting tools are crucial for successful treasure hunters. Whether you are an experienced prospector or just starting out, having the right equipm…

-

Uncovering Hidden Treasures with a Garrett Metal Detector for Gold

Garrett Metal Detector for Gold: Uncovering Hidden Treasures The search for gold has long been a pursuit of treasure hunters and prospectors alike. With a…

-

Unveiling the Power of Garrett Detector for Finding Gold

Garrett detectors are renowned for their ability to uncover hidden treasures, particularly gold. With their advanced technology and precision, Garrett dete…

-

Unveiling the Latest GPX Gold Detector Technology: A Game Changer

GPX gold detector technology has been a game changer in the field of gold prospecting and metal detection. With advancements in technology, the latest GPX…

-

The Gold Industry in the USA: A Closer Look

Gold in the USA has played a significant role in the country’s economy and history. The gold industry in the USA is a complex and multifaceted sector that…

-

Get Your Hands on the SDC 2300 for Sale Today!

SDC 2300 for Sale: Get Your Hands on the SDC 2300 for Sale Are you in the market for a top-of-the-line metal detector? Look no The SDC 2300 is now avail…

-

Innovative Prospector Tools Revolutionize Mining Industry

Prospector tools have long been essential for the mining industry, aiding in the search for valuable minerals and resources. However, with the introduction…

-

Discover Hidden Treasures: Buy a Metal Detector Today

Buy a metal detector today and embark on a journey to discover hidden treasures all around you. Utilizing the latest technology and innovative design, meta…

-

Unleashing the Power of the GPZ 7000: A Game-Changer in Metal Detection

The GPZ 7000 is a groundbreaking metal detector that has revolutionized the world of treasure hunting and mineral exploration. Its advanced technology and…

-

Unveiling the Garrett AT Gold: A Gamechanger for Prospectors

Garrett AT Gold: A Gamechanger for Prospectors The Garrett AT Gold metal detector has created waves in the world of prospecting with its state-of-the-art…

-

Discover Hidden Treasure with a State-of-the-Art Gold Detector Machine

Gold detector machines have revolutionized the way treasure hunters search for hidden treasures. With the advanced technology of a state-of-the-art gold de…

-

Uncovering the Best Gold Detector Prices: Tips for Choosing the Right Model

Gold Detector Price: Uncovering the Best Prices and Choosing the Right Model If you’re in the market for a gold detector, navigating the wide range of opt…

-

Discover Hidden Treasures with a Metal Detector for Sale

Metal detector for sale: Are you ready to uncover hidden treasures and unearth long-forgotten artifacts? With a metal detector for sale, you can explore th…

-

Affordable Gold Pan Prices for Prospecting Enthusiasts

Gold pan price is a significant factor for those passionate about prospecting for gold. Finding affordable gold pan prices can make a big difference for en…

-

Uncovering the Wealth: Gold Deposits in Australia

Gold deposits in Australia have long been a topic of interest for geologists, mining companies, and investors. With its rich history of gold mining and sig…

-

Uncovering Treasures: Whites Metal Detectors Lead the Way

Whites Metal Detectors have long been at the forefront of uncovering treasures buried beneath the earth’s surface. With their cutting-edge technology and p…

-

New Technology Detects Metal Detectors in High-Security Areas

Metal detector detection technology has taken a significant leap forward with the development of a new system that can detect the presence of metal detecto…

-

Exploring the World of Gold: Locator Techniques and Tips

Locator gold is a fascinating and sought-after mineral, and many people are drawn to the thrill of discovering it in the natural environment. In “Exploring…

-

Searching for Gold Diggings Near Me: Where to Start?

Gold digging near me – everyone dreams of striking it rich and finding a profitable gold digging spot close to home. Whether you’re a seasoned prospector o…

-

The Top 10 Great Detectors for Home Security

Great detectors are essential for ensuring the safety and security of your home. With various options available in the market, it can be overwhelming to ch…

-

Getting Started: Gold Prospecting for Beginners

Gold prospecting for beginners can be an exciting and rewarding hobby for anyone with an interest in the great outdoors and a sense of adventure. Whether y…

-

Exploring the Superior Technology of Minelab Company

Minelab Company is at the forefront of superior technology in the field of metal detectors and gold prospecting equipment. With a strong reputation for inn…

-

Detecting Metal Detectors: The Latest Advancements in Security Technology

Detecting Metal Detectors: The Latest Advancements in Security Technology Detect metal detectors are a crucial component of security measures in various p…

-

Top Metal Detector Brands: The Ultimate Guide to Quality Equipment

Top Metal Detector Brands: The Ultimate Guide to Quality Equipment When it comes to finding the best metal detector for your needs, it’s important to look…

-

Uncovering the Riches of Gold Mining in Australia

Gold mining in Australia has a rich history and continues to play a significant role in the country’s economy. With its vast natural resources and abundanc…

-

Top 5 Good Metal Detector Brands for Serious Treasure Hunters

Good metal detector brands are essential for serious treasure hunters who are looking for high quality and reliable equipment. With so many options availab…

-

Revolutionizing Gold Panning with the Latest Machine Technology

Gold panning machine technology has revolutionized the traditional method of extracting gold from rivers and streams. With the latest advancements in machi…

-

Discover the Best Gold Panning Near Me Locations for Prospectors

Gold Panning Near Me: For prospectors and enthusiasts alike, the thrill of finding gold is an exhilarating experience. Whether you’re a seasoned pro or a b…

-

Discover the Top 5 Best Metal Detector Brands for 2021

Best Metal Detector Brands: Discover the Top 5 for 2021 If you are in the market for a new metal detector, it’s important to know which brands are worth c…

-

Top 5 Metal Detector Brands for Your Next Adventure

Metal detector brands are an essential tool for any adventurer looking to uncover hidden treasures. When it comes to choosing the best metal detector for y…

-

Exploring New Techniques to Find Gold Deposits

Find gold in the exploration of new techniques is a top priority for geologists and mining companies looking to discover untapped gold deposits. With the e…

-

Uncovering Buried Treasure with Mine Lab: A Metal Detector Guide

Mine Lab is a leading name in the world of metal detecting, renowned for its advanced technology and innovative features. In our guide, “Uncovering Buried…

-

Exploring the World of Gold Mining: Techniques and Profitability

Gold mining is a fascinating and lucrative industry that has been prevalent for centuries. The extraction of gold from the earth involves a complex process…

-

Exploring the Benefits of Metal Detectors for Security and Safety

Metal detectors have become a crucial tool in enhancing security and safety in various environments. The use of metal detectors has proven to be effective…

-

Discover the Art of Hand Panning for Gold Prospecting

Hand Panning: Discover the Art of Hand Panning for Gold Prospecting Hand panning is an ancient, yet highly effective method of gold prospecting that allow…

-

Uncovering Treasures: The Best Metal Detector for the Price

Price for a metal detector is often a determining factor for many buyers when it comes to finding the best value. In this article, we will explore the top…

-

Revolutionizing Gold Mining with the Latest Miner Machine Technology

Gold mining has been a vital industry for centuries, with innovations in technology continually transforming the way it is carried out. One of the latest a…

-

Uncover Buried Treasure with a Gold Detector Metal

Gold detector metal is a cutting-edge tool that has revolutionized the search for buried treasure. With the ability to uncover hidden gold, silver, and oth…

-

Uncover Hidden Treasures with a Gold Detector: Your Ultimate Guide

Are you eager to uncover hidden treasures buried beneath the surface? Look no further than a gold detector to assist you in your quest. In this ultimate gu…

-

Uncovering Hidden Treasures: The Best Gold Metal Detector Technologies

Gold metal detectors are essential tools for anyone looking to uncover hidden treasures. Whether you are a passionate hobbyist or a professional treasure h…

-

Uncovering Treasure: The Best Gold & Metal Detectors for 2021

Gold & metal detectors have long been a popular tool for treasure hunters and hobbyists looking to find precious metal artifacts buried beneath the earth….

-

Essential Gold Hunting Tools for Successful Prospectors

Gold hunting tools are essential for successful prospectors to find and extract gold from the earth. From metal detectors to shovels and sluice boxes, havi…

-

Discover the Best Prospecting Tools for Gold Hunting

Prospecting Tools for Gold: If you’re a gold hunting enthusiast, you know that having the right tools at your disposal can make all the difference in your…

-

Uncover Hidden Treasures with Essential Gold Finding Tools

Gold finding tools are essential for any treasure hunter looking to uncover hidden treasures. Whether you’re a beginner or a seasoned prospector, having th…

-

Advanced Metal Detectors: Accurately Detecting Gold Particles

Advanced Metal Detectors: Accurately Detecting Gold Particles Metal detectors that detect gold have become increasingly advanced, allowing for more precis…

-

Improved Efficiency with the Latest Gold Mining Machine

Gold mining machine has been an essential tool in the process of extracting gold from the earth. With the latest advancements in technology, the efficiency…

-

Uncover Hidden Treasures with a Gold and Metal Detector

Gold and Metal Detector: Uncover Hidden Treasures Have you ever dreamt of uncovering buried treasure or stumbling upon a long-lost artifact? With a gold a…

-

New Gold Searching Machine: Revolutionizing Treasure Hunting

Gold searching machines have long been an essential tool for treasure hunters and prospectors seeking to strike it rich. With the development of new and im…

-

Find the Best Deals on Metal Detector Prices Online

Metal Detector Prices: Find the Best Deals Online Are you in the market for a metal detector but don’t want to break the bank? Look no With the vast array…

-

Uncovering hidden treasures: The best metal detectors for gold

Metal detectors for gold have become essential tools for uncovering hidden treasures in the modern age. With advancements in technology, there are now a wi…

-

Unlocking Hidden Treasures: The Power of the Garrett Metal Detector for Gold

Garrett Metal Detectors are renowned for their ability to uncover hidden riches, especially when it comes to finding gold. In this article, we will explore…

-

Discovering the Best Gold Detector Cost for Your Budget

Gold Detector Cost: Discovering the Best Option for Your Budget When it comes to searching for the best gold detector, one of the most important factors t…

-

Uncovering Treasure: Garrett Metal Detectors for Finding Gold

Garrett Metal Detectors are renowned for their ability to uncover hidden treasures, especially when it comes to finding gold. With advanced technology and…

-

Discovering Hidden Treasures: The Magic of Metal Detectors

Detektor metal: Discovering Hidden Treasures: The Magic of Metal Detectors Metal detectors have long been used as a tool for uncovering hidden treasures b…

-

Uncovering Hidden Treasures: The GPX Gold Detector Performance

GPX gold detector is a powerful tool that has revolutionized the search for hidden treasures. In this article, we will uncover the performance and capabili…

-

Introducing the Latest Gold Detector Machine for Improved Prospecting

Introducing the Latest Gold Detector Machine for Improved Prospecting. Looking to enhance your prospecting efforts and find gold more efficiently? Look no…

-

Unleashing the Power of Prospector Tools: Essential Must-Haves for Success

Prospector tools are a crucial component for anyone seeking success in their ventures. Unleashing the power of prospector tools can provide essential must-…

-

Where to Buy Metal Detector: The Ultimate Buying Guide

Buy Metal Detector: The Ultimate Buying Guide Are you in the market for a metal detector but not sure where to start? Look no This ultimate buying guide…

-

Uncovering the Best Deals: Gold Detector Price Revealed

Gold Detector Price: Uncovering the Best Deals Are you in the market for a gold detector but unsure of where to find the best deals? Look no further as we…

-

Finding Treasure: The Best Gold Detector Machine on the Market

Gold Detector Machine: Finding Treasure Are you a treasure hunter or enthusiast looking for the best gold detector machine on the market? Look no In this…

Search

About

Gold prospecting has been the standard method for extracting wealth from the earth since ancient times, when early prospectors used primitive tools to search for precious metals. This practice has continued through the centuries, adapting to modern technological advancements while maintaining its core essence. Gold prospecting remains an effective way to search for natural treasures, overcoming modern challenges and continuing to yield valuable discoveries.

Archive

Recent Posts

Tags

ايجار جهاز كشف الذهب ثمن جهاز ديب سيكر جهاز okm لكشف الذهب جهاز كشف الفراغات جهاز كشف المعادن والاثار جهاز كشف المياه جهاز كشف ذهب جي بي اكس 4500 سعر جهاز exp 6000 سعر جهاز جولد ستيب برو ماكس سعر جهاز ديب سيكر سعر جهاز وحش الذهب عمق جهاز وحش الذهب كاشف الذهب مخطط جهاز كشف الذهب كاشف المعادن الصغير

Gallery